Getting your VAT returns right isn’t just a matter of compliance—it’s about saving time, avoiding penalties, and keeping your finances in check. Yet, with ever-changing regulations and complex calculations, it’s easy to feel overwhelmed. That’s where a VAT calculator becomes your secret weapon.

A reliable VAT calculator takes the guesswork out of tax returns, ensuring accuracy with minimal effort. Whether you’re a business owner or a freelancer, using the right tool can simplify your process and give you confidence in your numbers. But how do you choose the best one for your needs? Let’s explore why a VAT calculator is essential and how it can transform your tax game.

Understanding VAT And Its Importance

VAT, or Value Added Tax, represents an integral part of modern tax systems, influencing businesses and consumers alike. It applies to goods and services at each stage of the supply chain, from production to sale. Businesses collect this tax on behalf of the government, making it both a responsibility and an opportunity for meticulous financial management. Without proper oversight, VAT errors can create penalties, impacting your cash flow and reputation.

Why does VAT matter in your daily operations? Beyond being a legal obligation, it contributes significantly to national revenue, funding public services and infrastructure. For businesses, VAT directly affects pricing, profitability, and competitive positioning. Mismanaging VAT might lead to audits, strained business relationships, or lost income. Precise calculations ensure compliance and safeguard your financial stability.

Do you already track VAT for every transaction? Failing to do so could lead to discrepancies. For example, reverse charges or variable VAT rates across borders add complexity. These nuances make understanding the principles of VAT essential. Knowing when and how much tax to charge, claim, or remit depends on accurate documentation and reconciling figures.

Businesses of all sizes should keep VAT transparency at the forefront. This can enhance customer trust, reduce errors, and streamline tax returns. Using digital tools, like a VAT calculator, simplifies these tasks. With real-time calculations, you might find managing VAT less daunting, even when regulations shift or records grow more intricate.

As legislation evolves, staying up to date has never been more critical. This ensures not just compliance but also an opportunity to optimise your financial strategies. Are you confident in your current VAT processes? Addressing common concerns today can save trouble tomorrow.

What Is A VAT Calculator?

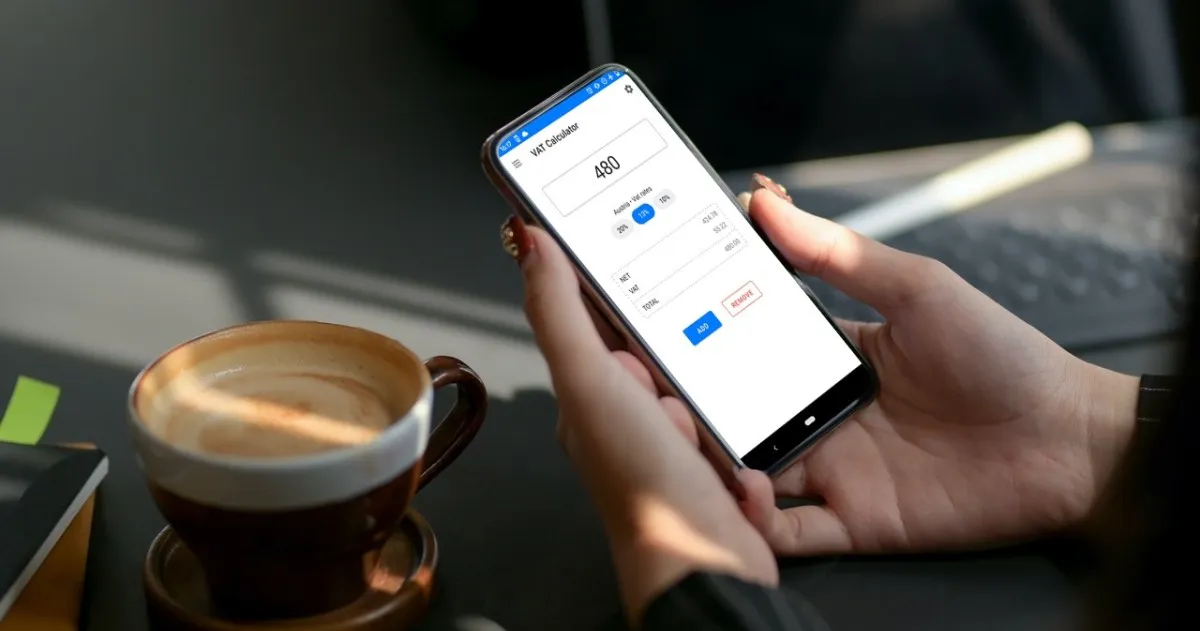

A VAT calculator is a digital tool designed to simplify Value Added Tax calculations. By automating these processes, it ensures accuracy in determining VAT amounts, whether you’re calculating VAT-inclusive or VAT-exclusive values.

Key Features Of A VAT Calculator

A VAT calculator includes precise functionality for adding and subtracting VAT percentages, catering to multiple VAT rates. It often provides error-free calculations to reduce manual mistakes. You might find exportable reports, useful for tax filing or audits, included in more advanced tools. Many calculators handle reverse charge and VAT exemptions, ensuring compliance with regional regulations.

How A VAT Calculator Simplifies Tax Returns

Using a VAT calculator streamlines complex computations, saving you effort during returns. Accurate VAT figures can be generated instantly, lowering the risk of penalties. Built-in features like record-keeping ensure documents are organised for audits or reviews. For businesses with variable rates, dynamic adjustments make tax calculation more manageable. These tools also mitigate errors by detecting inconsistencies before submission.

Benefits Of Using A VAT Calculator For Accurate Tax Returns

A VAT calculator transforms tax management, simplifying the process while enhancing every stage of VAT handling. Its benefits go beyond basic computations, impacting key business functions.

Improved Accuracy

Manual calculations often lead to small errors that grow into significant discrepancies. A VAT calculator eliminates this risk by delivering precise results for VAT-inclusive and VAT-exclusive amounts. It adjusts seamlessly to variable rates, ensuring consistent accuracy across invoices and transactions. If reverse charges or exemptions apply, the tool incorporates these directly into calculations without creating confusion. You can trust its results for reliable tax submissions and financial clarity.

Time Efficiency

VAT returns often consume hours, requiring focused attention on detail. A VAT calculator can reduce this time by automating rate applications, subtraction, and summation in seconds. Handling multiple rates across various regions becomes straightforward, removing manual steps that slow you down. With instant results and stored computations, you can refocus on critical tasks rather than dwelling on tax complexities.

Compliance With Tax Regulations

Tax regulations often change rapidly, introducing complexities many struggle to interpret. A VAT calculator updates rate systems and settings dynamically, helping you align with the latest rules effortlessly. These tools make tracking exemptions, reverse charges, or sector-specific VAT rates manageable, reducing errors that might lead to penalties. By using one, you ensure your returns reflect current legislation, protecting your business and reputation.

Choosing The Best VAT Calculator

Selecting the right VAT calculator simplifies tax management and increases your confidence in meeting compliance standards. A tailored tool ensures precise calculations, reducing the burden of complex VAT processes.

Factors To Consider

The most effective VAT calculators are user-friendly and aligned with your region’s tax regulations. Look for features such as multi-rate handling and exportable reports, as these make tracking transactions straightforward. Tools offering regular updates to reflect tax law changes improve compliance. If your business involves cross-border transactions, compatibility with reverse charges and exemptions might be crucial. Prioritise calculators that integrate with accounting software for a seamless workflow. Also, evaluate cost-effectiveness, ensuring the tool meets your needs without unnecessary expenses.

Popular VAT Calculator Tools

Well-known options include TaxCalc, Xero, and QuickBooks. TaxCalc specialises in ease of use for small businesses, simplifying VAT calculations through advanced features. Xero includes automatic updates to VAT rates and compliance tools suited for various industries. QuickBooks combines VAT tracking with detailed reporting functionalities. Other tools, like Avalara and TaxJar, cater to those needing specialised solutions for multi-country VAT compliance. Compare functionality against your requirements to determine the most suitable tool for you. Many of these solutions offer trials, letting you test capabilities before securing a subscription.

How To Use A VAT Calculator Effectively

Accurate utilisation of a VAT calculator supports compliance and simplifies tax management. Understanding specific steps and applying best practices ensures precise VAT calculations.

Step-By-Step Guide

- Identify VAT Type: Determine your calculation needs, whether VAT-inclusive or VAT-exclusive. For instance, calculating VAT for goods sold with varying rates (standard or reduced).

- Input Amount or VAT Rate: Enter the transaction value or appropriate VAT percentage into the calculator. Consistency matters in entering exact figures.

- Utilise Advanced Options: If multiple rates or exemptions apply, use features for handling diverse scenarios. A reverse charge mechanism might require adjustments.

- Review Outputs: Cross-check results for errors, especially for transactions with complex rates or non-standard tax rules.

- Stay Updated on Tax Rates: Regularly update your calculator’s rates to reflect legal or regional VAT changes. Missing an update can lead to mismatched returns.

- Check Data Entries: Errors in numeric entries affect outcomes. Ensuring precision in values reduces inaccuracies significantly.

- Use Integration Features: Connect your VAT calculator with accounting software for auto-calculations. This approach minimises manual input issues.

- Handle Special Cases Attentively: VAT exemptions or reverse charges might need adjustments manually. Verify these cases post-calculations.

In Closing

Leveraging a VAT calculator can transform how you manage your tax returns, saving time and reducing errors. By automating complex calculations and staying aligned with evolving regulations, you ensure compliance while protecting your business’s reputation.

Choosing the right tool tailored to your needs enhances efficiency and simplifies VAT processes. With the right approach, you can focus on growing your business, confident that your tax management is in capable hands.